|

Just a quick note, I have had two calls since yesterday from agents wanting advice on how to counsel a seller who wants to cancel a listing agreement with another brokerage. The quick answer is we can't and our agent should not be having this conversation with anyone who has an exclusive agreement with another brokerage. The only thing an agent should say to the seller regarding that is they need to work it out with their listing agent. SOP 16-6 expands on that but agents need to be cautious about giving any type of advice to a non-client.

BACK UP OFFER NOTIFICATION OF FIRST POSITION

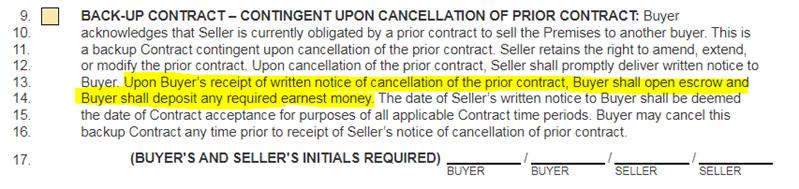

There's no requirement that you sign an addendum since all of the contractual terms were hammered out when your contract was negotiated originally. That Additional Clause Addendum says that once they deliver you notice that their first buyer canceled, you go and open escrow, and your time frames per the contract start that day.

BACK-UP OFFER, ADJUST COE DATE: WATCH YOUR DATES! LANGUAGE: “COE DATE ON PURCHASE CONTRACT WIIL BE ADJUSTED TO 30 DAYS PAST THE NOTIFICATION DATE THAT FIRST CONTRACT HAS CANCELLED AND BUYERS ARE NOW IN THE FIRST POSITION.”

We are unable to provide you with a legal opinion on this matter.

There is currently no state agency that enforces provisions in the Act, and because most landlord/tenant relations are private transactions, disputes that arise between landlord and tenants are generally considered private matters. If you are seeking guidance concerning the Residential Landlord and Tenant Act you may wish to consult an attorney. Public members who are not represented by an attorney, may find it helpful to contact free community legal services. See screenshot below for details. We also recommend the following Attorneys who specialize in Landlord/Tenant Law: Andrew Hull - LL side Hull, Holiday & Holiday 602-230-0088 Landlord/Tenant Atty Scott Williams 480-994-4732 scottw@zona.law (call first) Free Community Legal Services Legal Line: 602-258-3434

Fine tune: <CASE STUDY, Listing Quick Checklist .pdf> I use the attached listing "checklist" which has a link to the Maricopa County septic data base...

The biggest issue is when it is represented to be on sewer - but it is actually septic. When we rep both buyers and sellers. The problem does not occur when it is on a septic and all parties acknowledge that. The big problem is when SPDS, contract and MLS state sewer - and the buyer finds out after that it is on septic. It has happened multiple times. From trudy & Michael Orcutt 3/17/21 FYI - sewer/septic issues have been the #1 claim for HomeSmart - and many other brokerages as well - for many, many years now. Not certain we can really do much - except remind agents when we are speaking with them on the phone about inspections - to recommend their buyer get a sewer scope. Good topic for meetings too. Many home inspectors recommend this as part of their paperwork process. Getting all home inspectors to do this would be great for the industry. When reviewing the MLS print-outs (when we are listing agent) please keep your eye out for the word "New". That word has cost us $1000's of dollars over the years.. Much better to say, "XYZ installed March of 2021". I will create a new quick code for us to use when we see our agent using it in the MLS remarks. Any other suggestions to help us reduce claims are always welcome! We have also seen agents refer to HVAC systems as “new” when they area actually 3-5 years old, because the seller informs the listing agent that they are new. The problem is that the listing agent can’t simply rely on the seller’s representation if a consumer fraud claim is asserted by the buyer. That claim only requires proof that the listing agent made a false representation in the sale of the property. Relying on the seller is not a valid defense. I think another other way to limit claims is through MLS advertising. Terms like “new” should only be used if the item/property in question is literally brand new, with builder/manufacturer warranties, etc. As you know, many agents take liberties with that word and describe a full remodel as “new construction” or something similar. That term should only be used if literally ever single building components, including slab, foundation, drain lines, etc. is brand new and warranted. As for new claims, the most common this year relate to sewer/septic issues. Recent examples include drain lines failing shortly after close of escrow, and failing to disclose that the property is connected to a septic system. Although I don’t think the standard of care requires it, I think that buyer’s agents *should* require that their clients hire a plumber to scope the drain lines for any property at least 25 years old (or maybe 30?), and that should be a considered an ordinary inspection item no different than a home inspection report. The scope should verify sewer vs. septic and the condition of the drain lines, which should virtually eliminate these types of claims. If the buyer refuses to pay for an inspection, then we should consider a waiver form. I dislike the idea of adding additional forms, but this is such a common claim that it might be warranted.

Respa section 8 https://www.consumerfinance.gov/rules-policy/regulations/1024/14/

Can you please tell me what a Statement of Claimant is on line 26 of this document? Is it the name of the party whose name the well is registered to? Thank you! DWWA

|

|

Assignments |